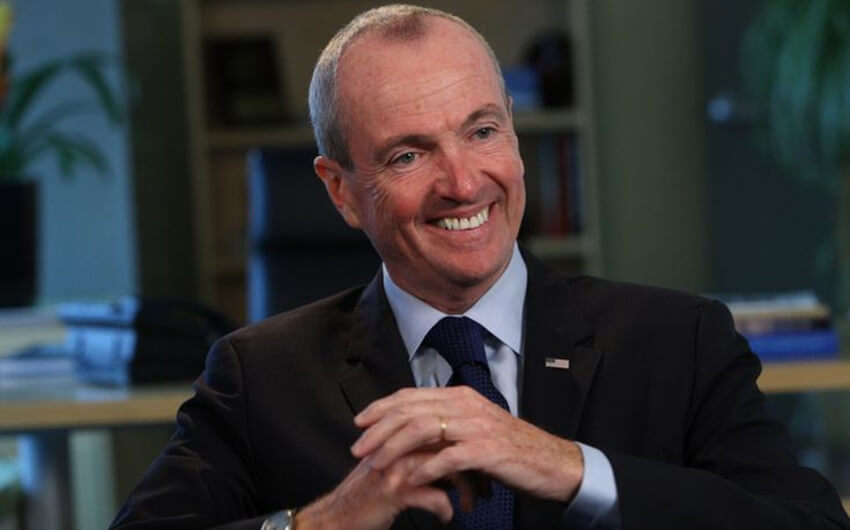

Governor Phil Murphy Net Worth Explained Through His Career, Assets, And Disclosures

If you’ve been searching governor phil murphy net worth, you’re probably trying to connect the dots between his Wall Street background and what that means financially today. Phil Murphy is one of those public figures whose wealth gets discussed almost as much as his policies, mostly because his pre-politics career was in high finance. The short version is that he’s widely considered very wealthy compared to the average governor, but the exact number depends on how you interpret public disclosures, market swings, and what private financial details simply aren’t available to the public.

Why the Governor Phil Murphy Net Worth Question Keeps Coming Up

When you look at Murphy’s career path, you can see why people keep asking about money. He spent decades at Goldman Sachs in senior roles, then shifted into public service. That combination usually sparks two questions:

- How much money did he make before politics?

- How much of that wealth does he still have today?

There’s also a deeper reason this question sticks: you’re living in a time when many people worry about whether wealthy politicians understand everyday financial pressure. So net worth becomes part of how people judge relatability, trust, and motives—even if the number itself doesn’t tell the whole story.

A Realistic Net Worth Range You Can Use Without Pretending It’s Exact

You’ll see a lot of different numbers online for governor phil murphy net worth, but a grounded way to describe it is this:

His net worth is generally viewed as being in the tens of millions of dollars, and many estimates place him somewhere in the $50 million to $100 million range.

You may also find higher claims, but those often rely on assumptions about private investments and valuations that aren’t fully visible. The most honest approach is to treat net worth as an estimate, not a proven fact, because no one outside the household (and the financial institutions involved) has a complete balance sheet.

What Public Tax Information Tells You (And What It Doesn’t)

Murphy and his family have released tax summaries in recent years, and while those documents don’t give you a precise net worth, they do reveal something important: their income can be extremely high in certain years. That’s usually a sign that investment income plays a major role.

Here’s what tax information can help you understand:

- Whether income is mostly salary-based or investment-based

- How much is coming from dividends, interest, and capital gains

- Whether income swings year to year (common with investment-heavy households)

- The scale of taxes paid, which usually correlates with high earnings

Here’s what tax documents typically won’t tell you clearly:

- the market value of every asset

- private investment stakes and what they’re worth today

- full real estate valuation across all holdings

- the complete picture of liabilities or debt

- what’s liquid cash versus long-term/illiquid holdings

So if you’re using public tax summaries to estimate net worth, you’re still working with only part of the puzzle.

Where Phil Murphy’s Wealth Likely Comes From

To understand the net worth conversation, it helps to break his finances into the main “buckets” that typically build wealth for someone with his background.

1) Goldman Sachs Career and High-Finance Compensation

Murphy spent decades at Goldman Sachs and held high-level roles. In that world, wealth often comes from more than just salary. Compensation can include:

- large annual bonuses

- long-term incentive pay

- equity and investment-style compensation

- retirement and deferred compensation structures

The key point is this: someone who reached senior levels in finance often builds wealth through compounding—wealth that continues to produce income later through investments.

2) Investments That Keep Producing Income

A household that reports significant annual income beyond a public salary is usually investment-driven. That can include:

- dividends from stocks

- interest from bonds or fixed income

- capital gains from selling investments

- returns tied to long-term holdings

This matters because it means the governor’s salary is not the main engine of wealth. If you’re wondering whether being governor “made” him rich, the answer is basically no. The wealth primarily comes from pre-politics finance work and investments that continue to perform.

3) Real Estate and Property Holdings

Real estate is another common wealth pillar for high-net-worth individuals. Property can increase net worth in obvious ways through appreciation, but it also comes with ongoing costs like:

- property taxes

- insurance

- maintenance and renovations

- staffing or management (depending on property type)

This is why real estate can make someone look even wealthier than they feel in cash terms. You can be “asset rich” and still have big monthly expenses.

4) Private Investments and Long-Term Holdings

This is where the public loses visibility. If someone holds private investments, partnership interests, or stakes that aren’t easily valued, net worth estimates become less precise.

That doesn’t mean the wealth isn’t real. It just means outsiders can’t verify every component the way you could with a public stock portfolio and a publicly listed home.

What His Governor Salary Tells You (And Why It Doesn’t Explain the Wealth)

New Jersey’s governor salary is significant in normal life, but it doesn’t explain tens of millions in wealth. When someone’s household income can reach into the millions in certain years, a six-figure government salary isn’t the main story.

So if you’re trying to understand the net worth question, the salary matters less than the assets and investment income that likely originated from his finance career.

Why Net Worth Estimates Vary So Much

If you’ve seen one website claim one number and another claim something wildly different, here’s why that happens:

Market swings can change the estimate fast

If a large portion of wealth is invested, a strong market year can push net worth higher, while a downturn can shrink it—without any lifestyle change.

Real estate values aren’t exact

Different valuation methods can change totals by millions.

Private holdings are difficult to price

If someone has private investments, outsiders often guess.

Debt and liabilities aren’t always visible

A person can own valuable assets and still have mortgages, loans, or other obligations that reduce net worth.

Some sites prioritize clicks over accuracy

A dramatic number spreads faster than a careful explanation.

A Practical Bottom Line You Can Use

If you want one clean, realistic takeaway: Governor Phil Murphy is widely considered to have a net worth in the high tens of millions, commonly discussed in the $50 million to $100 million range. The exact number isn’t fully verifiable publicly, but the combination of his high-finance career and investment-driven income makes it reasonable to place him well above most public officials.

If you’re trying to be accurate, the best way to describe it is: he’s very wealthy, his income appears heavily investment-based, and any precise net worth number should be treated as an estimate rather than confirmed fact.

Featured image source: Pinterest